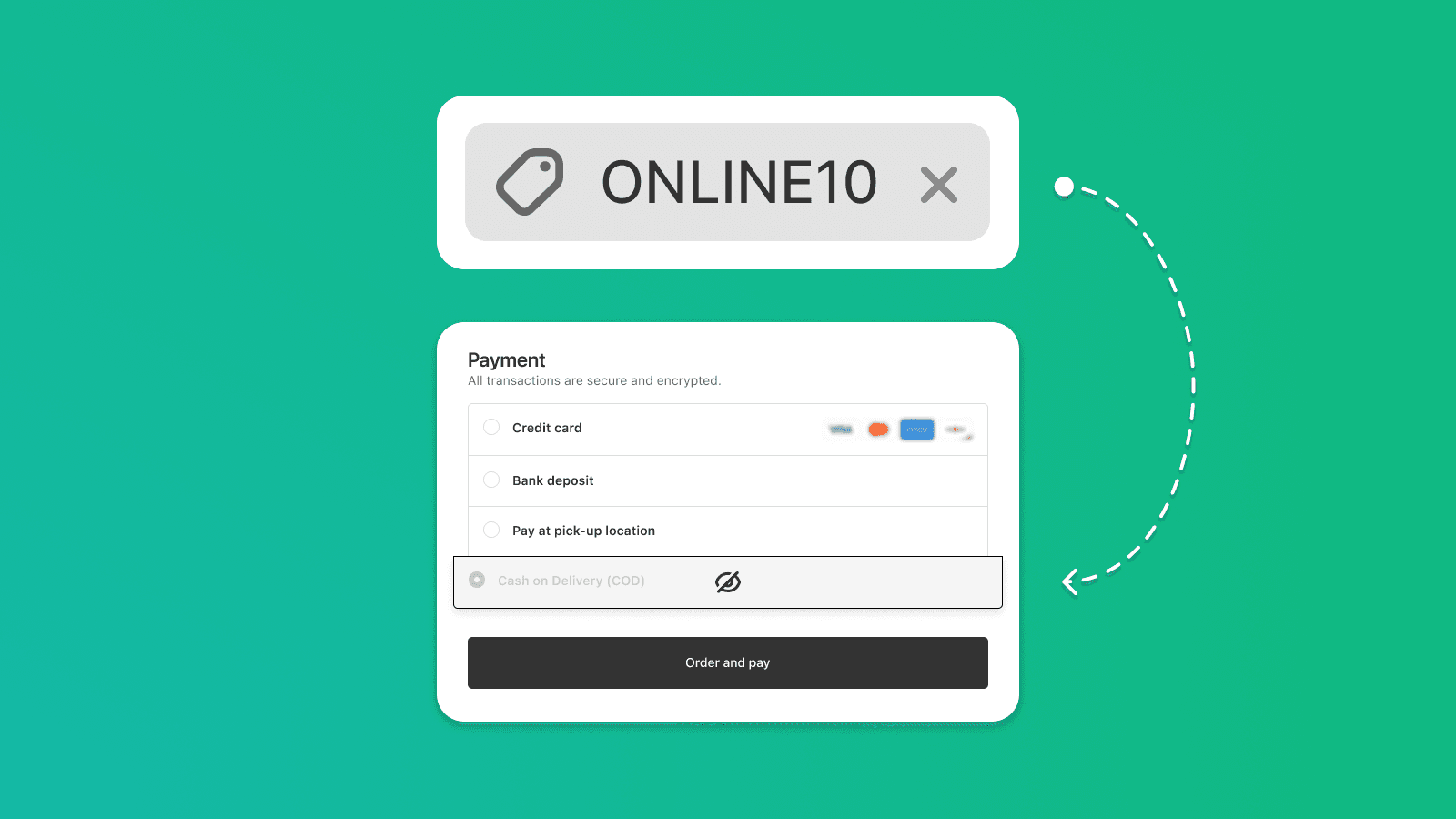

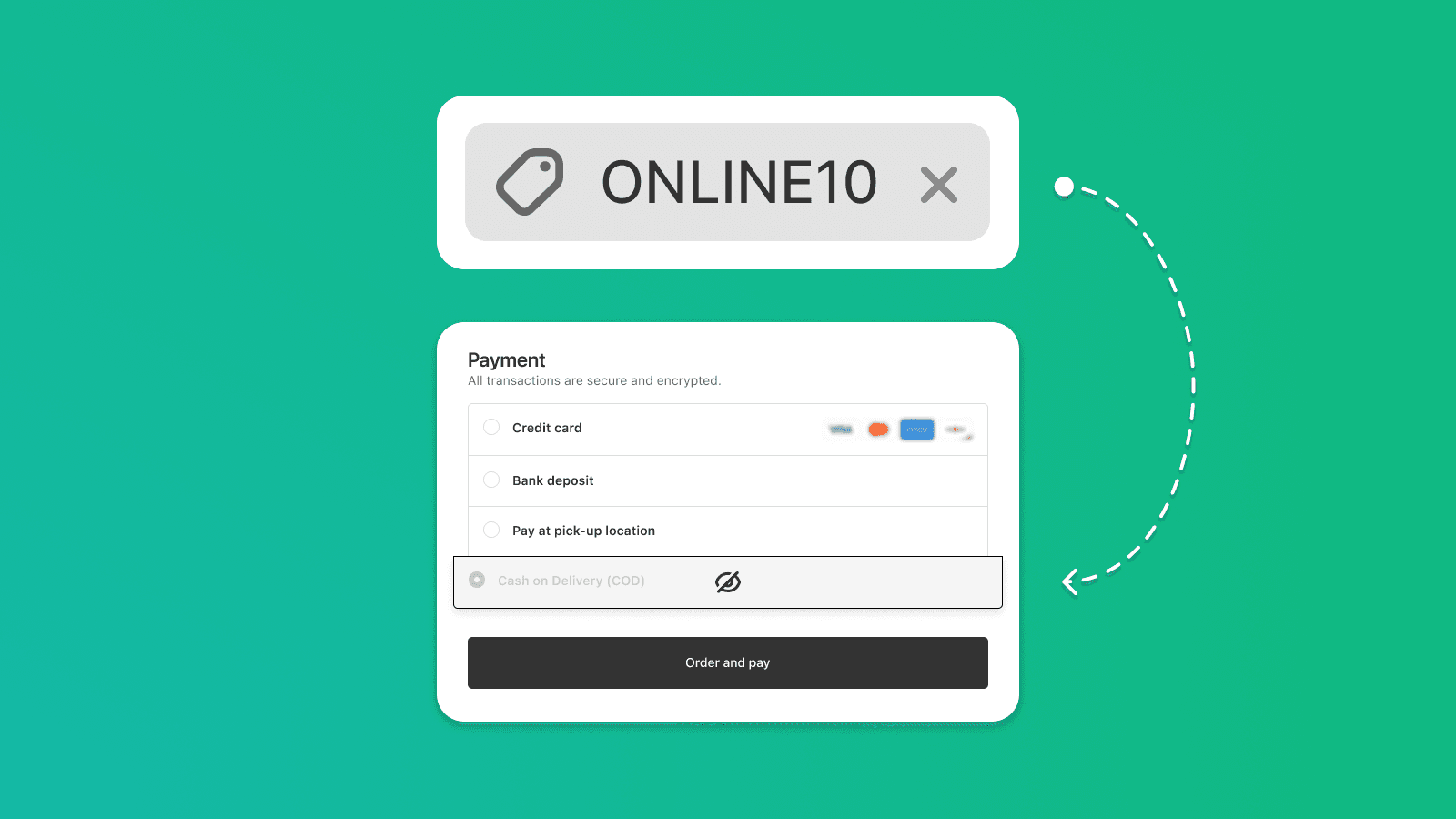

How to Set Discounts for Card Payments Only on Shopify 💳

Learn how to create conditional discounts based on payment method in Shopify. Hide COD, target prepaid payments only, and control when discounts apply using Payflow.

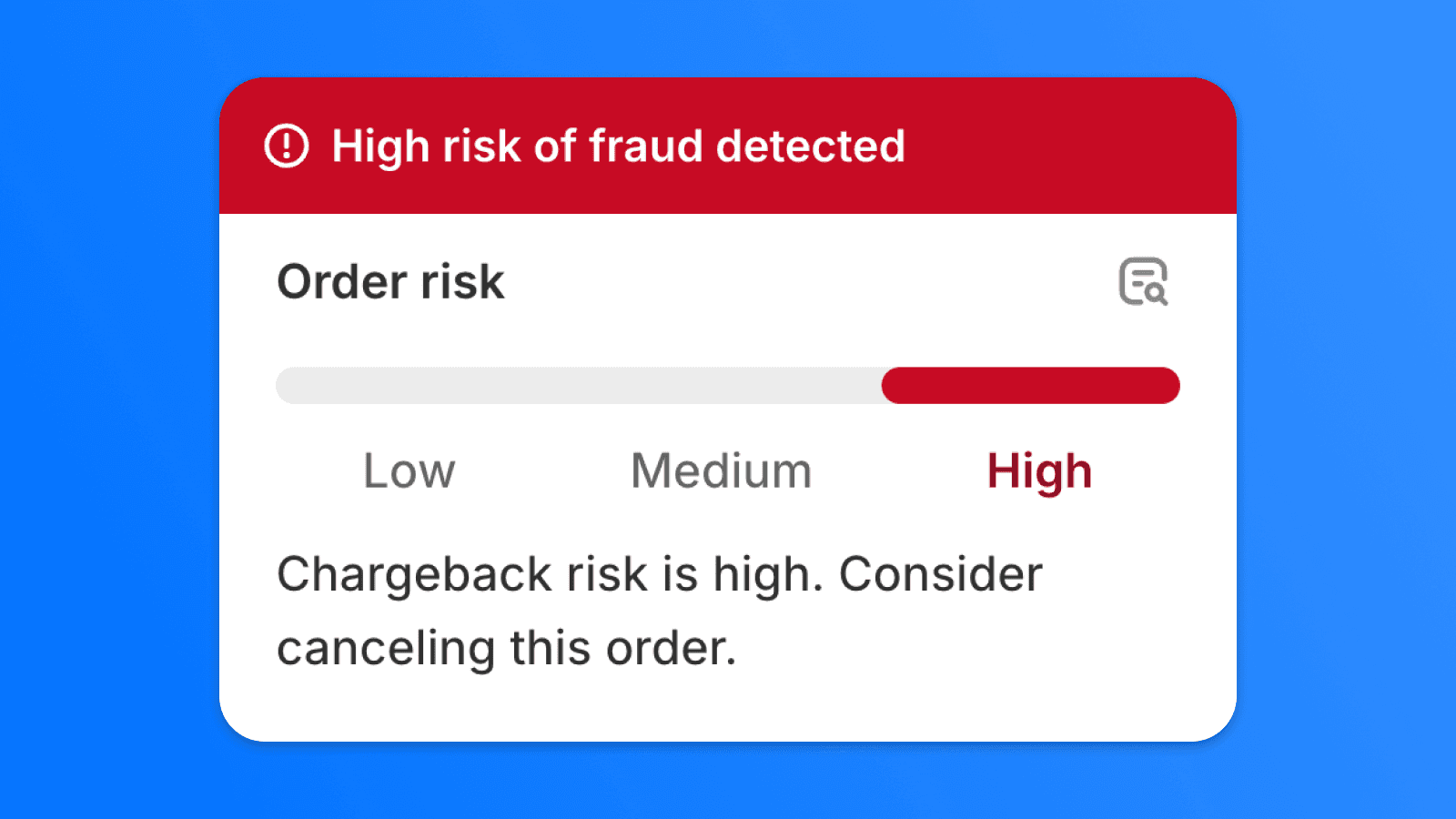

Chargebacks are one of the biggest challenges Shopify stores can face. Not only do you lose money from the order, but often also the product that was fraudulently purchased. In this article, we’ll take a look at how chargebacks work and how to effectively avoid them.

A chargeback is a process where a cardholder asks their bank for a refund on a transaction they consider unauthorized, disputed, or incorrect. This often happens when fraudsters use stolen credit or debit card details—for example, obtained from illegal sources like the darknet—to make online purchases.

The actual cardholder then notices an unfamiliar charge on their statement and contacts the bank to dispute it. The bank typically refunds the money to the cardholder, while the online store loses not only the payment but often also the product itself. This mechanism serves as consumer protection but poses a serious financial risk for online merchants.

Here’s an example of how to set up Shopify Flow to prevent chargebacks.

In Settings > Payments, change the payment capture method to “Manually”. This way, payments are authorized at the time of order but only captured after your review. If you detect a suspicious order, you can cancel it without any fees.

If you don’t want to review every order manually, you can automate the entire process with Shopify Flow completely free. Automation ensures that high-risk orders are automatically canceled while safe ones are approved without manual intervention. This reduces fraud risk and saves you time.

Get started with Shopify Flow automation: Download the template here.

Go directly to your Shopify Payments settings and add a unique four-digit code to your bank statement. Add your Business Name + Numeric Code in the Customer Billing Statement section of Shopify Payments. For example: SP * Appfleece 4376. Update this code regularly.

Fraudsters usually only have stolen credit card details but lack access to the bank account associated with the card. By asking the customer to verify a unique four-digit code from their bank statement, the real cardholder can easily provide it, while a fraudster cannot. This simple step helps you reliably detect fraudulent orders and protect your online store.

If a customer decides to initiate a chargeback despite all the above precautions, you will have strong evidence to resolve the dispute successfully. The bank will require the following information:

This evidence significantly increases your chances of successfully resolving a chargeback. Preventing chargebacks is crucial for the long-term stability of your online store and protection against fraud. By consistently using these methods, you can minimize the risk of fraudulent transactions and safeguard your business from unnecessary financial losses.

A chargeback is a process initiated by a cardholder who disputes a transaction with their bank, leading to a forced refund. This often occurs when fraudsters use stolen card details, and the legitimate cardholder then notices an unauthorized charge, causing the online store to lose both the payment and the product.

By setting payments to 'Manually' capture in Shopify Settings > Payments, you authorize payments at the time of order but only process them after reviewing the order. This allows you to identify and cancel suspicious orders before any money is transferred, effectively preventing potential chargebacks without incurring fees.

Yes, you can automate chargeback prevention using Shopify Flow. This free tool allows you to set up rules that automatically cancel high-risk orders while approving legitimate ones, saving you significant time and reducing fraud risk without manual intervention.

By adding a unique four-digit code to your Shopify Payments customer billing statement, you can ask customers flagged as medium/high risk to verify this code from their bank statement. Real cardholders can easily provide it, while fraudsters, who typically only have stolen card details and no bank access, cannot. This provides strong evidence against fraudulent claims.

To successfully resolve a chargeback dispute, you'll need compelling evidence. This includes screenshots where the customer verified the unique four-digit code, a screenshot of your payout screen showing the code, communication logs with the customer, shipping details (if applicable), and a clear timeline of events related to the transaction.

Learn how to create conditional discounts based on payment method in Shopify. Hide COD, target prepaid payments only, and control when discounts apply using Payflow.

Setting up Cash on Delivery (COD) with a fee can be tricky for Shopify merchants. But with the Payflow app, it’s easy! Streamline the process and create a smooth, hassle-free experience for your customers—without the stress.

Displaying sold-out products can lead to frustration for customers who are looking for available items. In this guide, we will show you how to hide sold-out products from your Shopify collections entirely by modifying your theme code.

If you have products that are currently out of stock, it can be beneficial to display them at the end of the product list in your collection. This way, you ensure that customers see the available items first, followed by the out-of-stock products.

Interested in collaborating on a project?